Notes (4/1/15)

SRAS: Time to shorten wages to adjust to price level

- Workers may not be aware of changes in real wages due to inflation and have adjusted their supply decisions and wages accordingly

Nominal Wages: Amount of money received per day, per hour, per year

Real Wages: Adjusted foreign inflation

Sticky Wages: Nominal wage level is set accordingly to initial price level and does not vary (Ex. Stamps)

Range 1 & 2- Wages are sticky

LRAS: Time long enough for wages to adjust to price level

Notes (4/2/15)

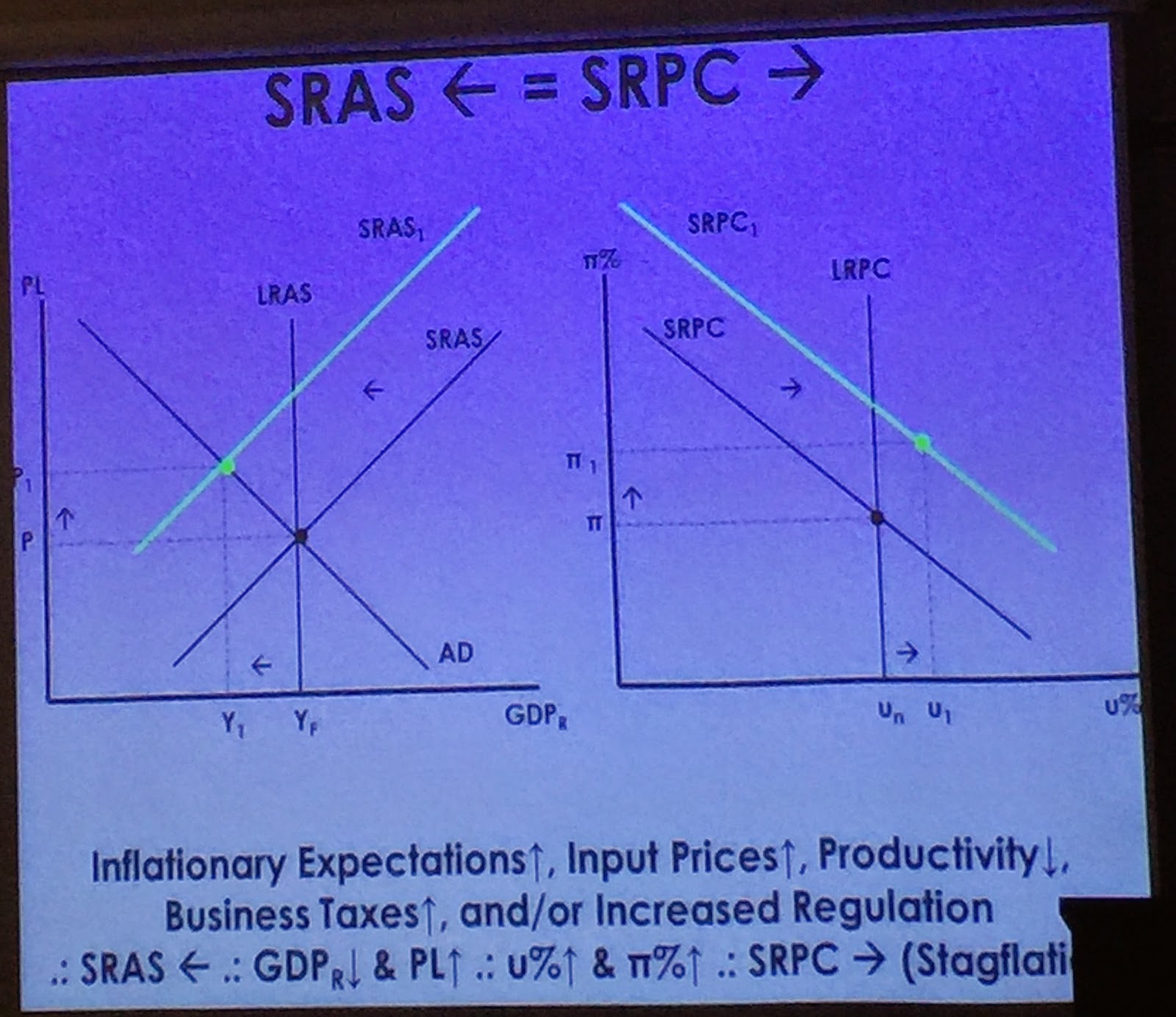

Philips Curve:

- Represents the relationship b/t unemployment and inflation

- Trade off b/t inflation and unemployment only occur in short run

Long-Run:

- Occurs at natural rate of unemployment (4-5%)

- Represented by vertical line

- No trade off b/t unemployment and inflation in long run (economy produces at FE)

LRPC (Long-Run Philips Curve)

- Will only shift if LRAS curve shifts, otherwise stable

- 3 Types of Unemployment: change in natural rate of unemployment- seasonal, frictional, structural

- LRPC assumption is that more worker benefits create higher natural rates and fewer worker benefits create lower natural rates

- No tradeoff b/t unemployment and inflation

SRPC (Short-Run Philips Curve)

- An inverse relationship b/t inflation and unemployment (when inflation increases; unemployment decreases)

- Have relevance to Okun's Law

- Since wages are sticky, inflation changes; moves the points on SRPC

- If inflation persist and expected rate of inflation rise, then entire SRPC moves up, which causes Shock Inflation

- If inflation expectation drop due to new technology or economic growth, then SRPC moves down

- AS shock can cause both higher rate of inflation and higher rates of unemployment

- Supply shocks are rapid and significant increases in resource cost

Missery Index: Combination of unemployment and inflation in any given year (single digit misery is good) 2-3% if inflation is 10%; unemployment is 4-5%; if inflation is over heated, so is unemployment)

Notes (4/6/15)

Long-Run Philips Curve:

- b/c LRPC exist at natural rate of unemployment (Un) structural changes in economy that affect Un, which would also cause LRPC to shift

- Increase in Un shift LRPc right

- Decrease in Un shift LRPC left

- Change in technology, economic growth = LRPC to shift

Stagflation: High inflation & Un at the same time (Ex. Women's Movement) Could go into recession

Disinflation: Reduction in inflation rate from year to year (Nominal Interest Rate- unadjusted rates)

Deflation: Relation in which there is an actual drop in price level (opposite of inflation)

Notes (4/7/15)

Supply Side Economics:

- It is the belief that the AS curve will determine levels of inflation, Un, and economic growth.

- To increase the economy, the AS curve shifts right, which will always benefit the company first.

- Focus on Marginal Tax Rates- amount payed on last dollar earned or on each additional dollar earned.

- By reducing the marginal tax rate, supply siders believe that you will encourage people to work longer and forego leisure for extra income.

- They support policies that promote GDP growth by arguing high marginal tax rate along with current system of transfer payments they provide disincentives to work, invest, and undertake entrepreneurial ventures.

Raegan Nomies: Lowered marginal tax rate to get out of recession, going into deficit.

- More government regulation = deficit

- Less government regulation = surplus

Laffer Curve: Tradeoff between tax rates and government revenue.

- Used to support supple side argument

3 Criticisms of Laffer Curve:

- Research suggest impact of tax rates on incentives to work, save, and invest are small

- Tax cuts increase demand, which can fuel inflation and causes demand to exceed supply

- The economy is actually located on curve is difficult to determine